What Is The Income Tax In Georgia . use our income tax calculator to estimate how much tax you might pay on your taxable income. Higher earners pay higher rates,. This year's individual income tax forms. 2023 tax table.pdf (pdf, 219.83 kb) 2023. it is recommended to use the tax rate schedule for the exact amount oftax. — georgia utilizes a relatively simple progressive income tax system, with rates ranging from 1.00% to 5.75%. — how is income taxed in georgia? The georgia tax center (gtc) is an accurate and safe way for. For the 2023 tax year, georgia’s six state income tax brackets ranged from 1 to 5.75 percent. the georgia income tax has six tax brackets, with a maximum marginal income tax of 5.750% as of 2024. georgia has a progressive income tax system with six tax brackets that range from 1.00% up to 5.75%. Your tax is $0 if your income is.

from www.formsbank.com

The georgia tax center (gtc) is an accurate and safe way for. Higher earners pay higher rates,. Your tax is $0 if your income is. use our income tax calculator to estimate how much tax you might pay on your taxable income. This year's individual income tax forms. — how is income taxed in georgia? it is recommended to use the tax rate schedule for the exact amount oftax. — georgia utilizes a relatively simple progressive income tax system, with rates ranging from 1.00% to 5.75%. 2023 tax table.pdf (pdf, 219.83 kb) 2023. the georgia income tax has six tax brackets, with a maximum marginal income tax of 5.750% as of 2024.

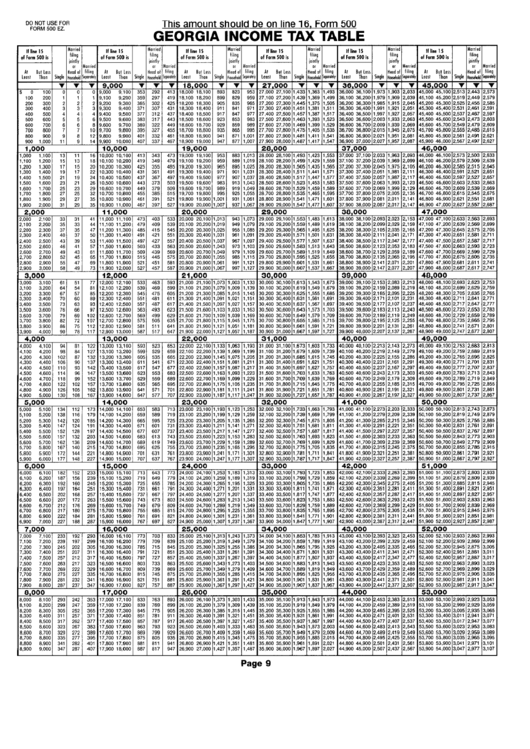

Form 500 Tax Table printable pdf download

What Is The Income Tax In Georgia For the 2023 tax year, georgia’s six state income tax brackets ranged from 1 to 5.75 percent. the georgia income tax has six tax brackets, with a maximum marginal income tax of 5.750% as of 2024. — how is income taxed in georgia? — georgia utilizes a relatively simple progressive income tax system, with rates ranging from 1.00% to 5.75%. Your tax is $0 if your income is. georgia has a progressive income tax system with six tax brackets that range from 1.00% up to 5.75%. For the 2023 tax year, georgia’s six state income tax brackets ranged from 1 to 5.75 percent. This year's individual income tax forms. The georgia tax center (gtc) is an accurate and safe way for. 2023 tax table.pdf (pdf, 219.83 kb) 2023. Higher earners pay higher rates,. it is recommended to use the tax rate schedule for the exact amount oftax. use our income tax calculator to estimate how much tax you might pay on your taxable income.

From www.formsbank.com

Form 500 Tax Table printable pdf download What Is The Income Tax In Georgia The georgia tax center (gtc) is an accurate and safe way for. This year's individual income tax forms. Higher earners pay higher rates,. 2023 tax table.pdf (pdf, 219.83 kb) 2023. — how is income taxed in georgia? it is recommended to use the tax rate schedule for the exact amount oftax. For the 2023 tax year, georgia’s six. What Is The Income Tax In Georgia.

From gbpi.org

The Tax Cuts and Jobs Act in High Households Receive What Is The Income Tax In Georgia georgia has a progressive income tax system with six tax brackets that range from 1.00% up to 5.75%. 2023 tax table.pdf (pdf, 219.83 kb) 2023. The georgia tax center (gtc) is an accurate and safe way for. it is recommended to use the tax rate schedule for the exact amount oftax. the georgia income tax has six. What Is The Income Tax In Georgia.

From studylib.net

A Flat Rate Tax in Brief What Is The Income Tax In Georgia use our income tax calculator to estimate how much tax you might pay on your taxable income. Your tax is $0 if your income is. Higher earners pay higher rates,. 2023 tax table.pdf (pdf, 219.83 kb) 2023. For the 2023 tax year, georgia’s six state income tax brackets ranged from 1 to 5.75 percent. georgia has a progressive. What Is The Income Tax In Georgia.

From statetaxesnteomo.blogspot.com

State Taxes State Taxes Tax What Is The Income Tax In Georgia For the 2023 tax year, georgia’s six state income tax brackets ranged from 1 to 5.75 percent. use our income tax calculator to estimate how much tax you might pay on your taxable income. — how is income taxed in georgia? Your tax is $0 if your income is. the georgia income tax has six tax brackets,. What Is The Income Tax In Georgia.

From www.youtube.com

State of tax Form YouTube What Is The Income Tax In Georgia The georgia tax center (gtc) is an accurate and safe way for. georgia has a progressive income tax system with six tax brackets that range from 1.00% up to 5.75%. it is recommended to use the tax rate schedule for the exact amount oftax. — how is income taxed in georgia? — georgia utilizes a relatively. What Is The Income Tax In Georgia.

From janelaqgwenora.pages.dev

State Tax Rate 2024 Averil Devondra What Is The Income Tax In Georgia — georgia utilizes a relatively simple progressive income tax system, with rates ranging from 1.00% to 5.75%. use our income tax calculator to estimate how much tax you might pay on your taxable income. Your tax is $0 if your income is. This year's individual income tax forms. The georgia tax center (gtc) is an accurate and safe. What Is The Income Tax In Georgia.

From taxfoundation.org

State Tax Rates and Brackets, 2022 Tax Foundation What Is The Income Tax In Georgia the georgia income tax has six tax brackets, with a maximum marginal income tax of 5.750% as of 2024. it is recommended to use the tax rate schedule for the exact amount oftax. use our income tax calculator to estimate how much tax you might pay on your taxable income. georgia has a progressive income tax. What Is The Income Tax In Georgia.

From www.signnow.com

Form 500 Complete with ease airSlate SignNow What Is The Income Tax In Georgia georgia has a progressive income tax system with six tax brackets that range from 1.00% up to 5.75%. it is recommended to use the tax rate schedule for the exact amount oftax. The georgia tax center (gtc) is an accurate and safe way for. Higher earners pay higher rates,. 2023 tax table.pdf (pdf, 219.83 kb) 2023. —. What Is The Income Tax In Georgia.

From taxfoundation.org

Tax Reforms in 20042012 Global Tax Policy What Is The Income Tax In Georgia georgia has a progressive income tax system with six tax brackets that range from 1.00% up to 5.75%. — georgia utilizes a relatively simple progressive income tax system, with rates ranging from 1.00% to 5.75%. the georgia income tax has six tax brackets, with a maximum marginal income tax of 5.750% as of 2024. 2023 tax table.pdf. What Is The Income Tax In Georgia.

From www.scribd.com

2019 Individual Tax Filing Guide Forms 500, 500EZ What Is The Income Tax In Georgia use our income tax calculator to estimate how much tax you might pay on your taxable income. — how is income taxed in georgia? Your tax is $0 if your income is. Higher earners pay higher rates,. the georgia income tax has six tax brackets, with a maximum marginal income tax of 5.750% as of 2024. The. What Is The Income Tax In Georgia.

From gbpi.org

Reimagining Revenue How Tax Code Contributes to Racial and What Is The Income Tax In Georgia Your tax is $0 if your income is. The georgia tax center (gtc) is an accurate and safe way for. — how is income taxed in georgia? For the 2023 tax year, georgia’s six state income tax brackets ranged from 1 to 5.75 percent. This year's individual income tax forms. georgia has a progressive income tax system with. What Is The Income Tax In Georgia.

From veremountain.weebly.com

2021 tax brackets veremountain What Is The Income Tax In Georgia Your tax is $0 if your income is. — how is income taxed in georgia? For the 2023 tax year, georgia’s six state income tax brackets ranged from 1 to 5.75 percent. The georgia tax center (gtc) is an accurate and safe way for. This year's individual income tax forms. — georgia utilizes a relatively simple progressive income. What Is The Income Tax In Georgia.

From www.signnow.com

Tax Rate Complete with ease airSlate SignNow What Is The Income Tax In Georgia georgia has a progressive income tax system with six tax brackets that range from 1.00% up to 5.75%. use our income tax calculator to estimate how much tax you might pay on your taxable income. The georgia tax center (gtc) is an accurate and safe way for. Your tax is $0 if your income is. the georgia. What Is The Income Tax In Georgia.

From gbpi.org

The Tax Cuts and Jobs Act in High Households Receive What Is The Income Tax In Georgia Your tax is $0 if your income is. Higher earners pay higher rates,. This year's individual income tax forms. use our income tax calculator to estimate how much tax you might pay on your taxable income. 2023 tax table.pdf (pdf, 219.83 kb) 2023. it is recommended to use the tax rate schedule for the exact amount oftax. . What Is The Income Tax In Georgia.

From gbpi.org

Revenue Primer for State Fiscal Year 2022 Budget and What Is The Income Tax In Georgia Higher earners pay higher rates,. it is recommended to use the tax rate schedule for the exact amount oftax. use our income tax calculator to estimate how much tax you might pay on your taxable income. 2023 tax table.pdf (pdf, 219.83 kb) 2023. The georgia tax center (gtc) is an accurate and safe way for. georgia has. What Is The Income Tax In Georgia.

From www.signnow.com

Tax Forms 500 and 500EZ for Tax for Ga Fill Out and What Is The Income Tax In Georgia The georgia tax center (gtc) is an accurate and safe way for. This year's individual income tax forms. Higher earners pay higher rates,. the georgia income tax has six tax brackets, with a maximum marginal income tax of 5.750% as of 2024. georgia has a progressive income tax system with six tax brackets that range from 1.00% up. What Is The Income Tax In Georgia.

From www.thegeorgiavirtue.com

Here is how all 50 states rank for individual taxes • The What Is The Income Tax In Georgia georgia has a progressive income tax system with six tax brackets that range from 1.00% up to 5.75%. This year's individual income tax forms. The georgia tax center (gtc) is an accurate and safe way for. the georgia income tax has six tax brackets, with a maximum marginal income tax of 5.750% as of 2024. Your tax is. What Is The Income Tax In Georgia.

From taxfoundation.org

State Tax Rates and Brackets, 2021 Tax Foundation What Is The Income Tax In Georgia use our income tax calculator to estimate how much tax you might pay on your taxable income. it is recommended to use the tax rate schedule for the exact amount oftax. georgia has a progressive income tax system with six tax brackets that range from 1.00% up to 5.75%. Higher earners pay higher rates,. Your tax is. What Is The Income Tax In Georgia.